Global Decorative Paints and Coatings Market Size, Insights, Drivers, Opportunities, By Product (Decorative, Protective Coating, Industrial Wood Coating, Powder Coating, Automotive Coating, Others), By Type (Water Based, Solvent Based), By Region, Growth, Trends and Forecast From 2019 To 2027

Global Decorative Paints and Coatings Market Size, Insights, Drivers, Opportunities, By Product (Decorative, Protective Coating, Industrial Wood Coating, Powder Coating, Automotive Coating, Others), By Type (Water Based, Solvent Based), By Region, Growth, Trends and Forecast From 2019 To 2027

Historic years: 2015 to 2017 Base Year: 2018 Forecast Years: 2019 to 2027

Number of pages: 100 Category: Chemical Report Id: MISCH5504

Market Insights

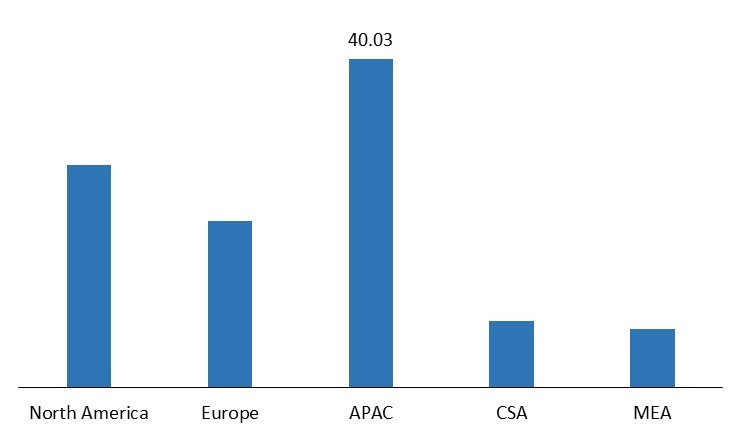

The global decorative paints and coatings market was valued at USD 102.52 billion in 2018 and is estimated to reach a value of USD 179.85 billion in 2027. Major driver attributing to the growth of this market are expanding automotive industry and growing construction activities at a global level. Growth in the construction industry will have a direct influence over the decorative paints sector. It has been expected that the global construction market will reach USD 8 trillion in 2030. This industry will create a large requirement for paint and repaint category. Major growth is expected to come from China, India in the next five years.Global decorative paints and coatings market size by region, 2018 (USD Billion)

It has been observed that the demand for smart coatings has increased in commercial applications due to its usage for the restoration of historical buildings. Besides that, some of the key advantages which attract the consumer to buy smart coating are its ability to be used as a composite to save weight on an aircraft, and cover damage on an aero engine or oil and gas platform. Some of the key players operating are PPG Industries, 3M, AkzoNobel, and others.

It has been observed that the demand for smart coatings has increased in commercial applications due to its usage for the restoration of historical buildings. Besides that, some of the key advantages which attract the consumer to buy smart coating are its ability to be used as a composite to save weight on an aircraft, and cover damage on an aero engine or oil and gas platform. Some of the key players operating are PPG Industries, 3M, AkzoNobel, and others.

Product Insights

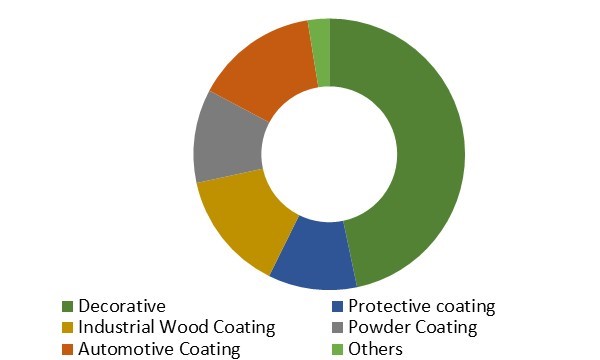

The decorative category was valued to be the largest category in 2018. the requirement of paint and repaint the living and working space to maintain the standard of living is driving the market growth. An increasing number of commercial properties and rocketing construction of skyscrapers is expected to boost the market demand over the forecast period. Automotive paints category is estimated to be the fastest growing market from 2019 to 2025. Features such as scratch resistance along with improved gloss finishing and corrosion resistance are attributing to the market. Companies are providing customized vehicle painting options which are expected to further drive the demand for automotive paints. Growing production of supplementary industries such as marine, automotive, aerospace, and general industry is also affecting the growth. In the aircraft industry over 75% of the coating is painting is done on the commercial segment. Marine coatings systems are applied to ships and structures in both the sea and freshwater environments. Marine paints and coating products are highly consolidated in nature. AkzoNobel, Chugoku Marine Paints, PPG Industries, Inc., Hempel's Marine Paints, and Jotun accounted for over 80% of the shares.Type Insights

Water-based paints segment was valued to be the largest category by accounting 60.97% of the global market in 2018. Consumer prefers to use water-based color due to its odor free and quick dry nature. Solvent-based paints are expected to be the fastest growing category over the forecasted period. Growing automotive and oil & gas industry will significantly increase the sales of solvent based color in coming years.Global decorative paints and coatings market value share by type, 2027 (%)

Regional Insights

The Asia Pacific was valued to be the largest and fastest growing market. Growing urbanization is generating the demand for decorative paints Large automotive industry investment in China, India and South Korea is driving the growth of automotive paints. Asian Paints accounts for the largest market share in this region. Large distribution network and product varieties have helped them increase their involvement. North America is the second largest market. In 2018, the market was valued at USD 27.08 billion. Large construction and automotive industry are key factors of this regions’ growth. Large players are acquiring smaller companies to increase their market share. For instance, PPG Industries, Inc. acquired automotive coatings manufacturer Hemmelrath in April 2019.Competitive Landscape

The decorative paints and coating market is highly fragmented with the presence of many brands in the market. Some of the key players operating in this market are AkzoNobel, PPG Industries, Inc., Nippon Paint Holdings Co., Ltd., The Sherwin-Williams Company, Asian Paints, Kansai Paint Co. Ltd., Jotun, BASE SE, RPM International Inc., and Solvay. Companies are coming up with new innovations to increase their market share. For instance, Sherwin-Williams had come up with a paint shield concept. As per their marketing team, this paint has an ability to kill 99.9% of the germs.Research Methodology

The following report consists of market analysis including both primary and secondary research. Primary research comprises the interaction between manufacturers, industry experts, and channel partners, while the secondary research presents an analytical interpretation of relevant publications which contains details like proprietary databases, purchased database, company annual reports, and financial reports. For the single, team and corporate user license, we will provide 15% free customization of the report. However, alternatively, if you are looking for additional data or insight related to the scope of the report, you may purchase the "Customized Research License". Please put an inquiry for the pricing details.Highlights of the report:

- All market drifts, drivers and opportunities

- Understanding the dynamics of the parent market

- Prime fluctuations of the business dynamics

- Historical, current, and projected size of the market with respect to production and sales

- Segmentation and comprehensive analysis in the second or third level

- Reporting and evaluation of recent industry developments

- Detailed profiling of leading companies

- Opportunities to newer trends in global, regional and country markets

- Analyzing the trajectory line of the business

- Measures to consider for products in the industry

Segments covered in the report

Product Outlook- Decorative

- Protective coating

- Industrial wood coating

- Powder coating

- Automotive coating

- Others

- Water based

- Solvent based

- North America

-

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- Central & South America

- Brazil

- Middle East & Africa