Global Coating Additives Market Size, Insights, Drivers, Opportunities, By Type (Acrylics, Fluoropolymers, Urethanes, Metallic Additive, Others), By Function, By Formulation, By Application, By Region, Growth, Trends and Forecast from 2019 to 2027

Global Coating Additives Market Size, Insights, Drivers, Opportunities, By Type (Acrylics, Fluoropolymers, Urethanes, Metallic Additive, Others), By Function, By Formulation, By Application, By Region, Growth, Trends and Forecast from 2019 to 2027

Historic years: 2015 to 2017 Base Year: 2018 Forecast Years: 2019 to 2027

Number of pages: 100 Category: Chemicals Report Id: MISCH5003

Market Insights

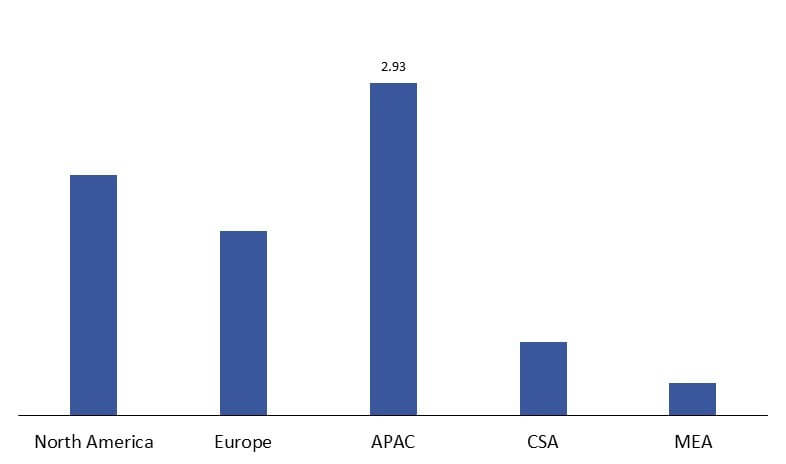

The global coating additives market was valued at USD 7.62 billion in 2018 and is estimated to reach a value of USD 14.09 billion in 2027. The market is analyzed to rise at a CAGR of 7.07% over the forecast period of 2019 to 2027. The rise in use of aqueous additives with a shift in focus from solvent based additives has been a factor for growth of market over the forecast period. Moreover, the rising number of applications of products such as automotive, furniture and construction has also been estimated to drive this segment over the years.Global coating additives market size by region, 2018 (USD Billion)

Primary and secondary researchers have identified AkzoNobel N.V., Arkema Group, Ashland Inc., BASF SE, BYK Additives & Instruments, The DOW Chemical Company, Solvay S.A., Evonik Industries AG as the key players in the global coating additives market. However, upon analysis of this segment, factors like company revenue, industry trends contribute in selecting a particular category of product. Further coating additives companies are looking forward to investing in different product types.

Primary and secondary researchers have identified AkzoNobel N.V., Arkema Group, Ashland Inc., BASF SE, BYK Additives & Instruments, The DOW Chemical Company, Solvay S.A., Evonik Industries AG as the key players in the global coating additives market. However, upon analysis of this segment, factors like company revenue, industry trends contribute in selecting a particular category of product. Further coating additives companies are looking forward to investing in different product types.

Type Insights

Acrylics is estimated to be the largest segment holding a share of about 39.16% share in the market. A large demand for the product due to water soluble and quick drying properties makes it to grow at a high CAGR. Fluoropolymers is expected to be the fastest growing category over the forecast period of 2019 to 2027. Exceptional properties provided by product such as weather stability, chemical resistance, low coefficient of friction, low surface energy etc. is driving the market growth.Function Insights

Rheology modification was estimated to account for the largest share in 2018. The segment provides excellent optimal functionality and fluidity to the surface. The product also imparts excellent finishing for the coating surface. Anti-foaming function is estimated to rise at a significant CAGR over the forecast period of 2019 to 2027. However, excessive demand for preventing foams on coating products provides a reasonable growth in market.Formulation Insights

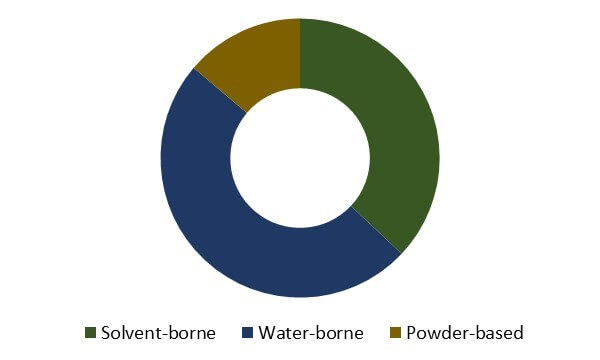

Water-borne type is the largest segment and is expected to grow at a CAGR of 6.74% over the forecasted period of 2019 to 2027. The rising demand of water borne coating additives among different applications in contrast to different environment regulations is attributing to the segment growth. The rising demand for solvent borne coating additives is boosting the market growth over the forecast period.Application Insights

Architectural segment was valued to be the largest application type accounting for over 35% of market share in 2018. The rise in commercial and residential construction across the developing countries helps to drive the growth of the market over the forecast period. Moreover, high demand across the automotive sector makes it to grow at a significant CAGR in the market over the coming years.Global coating additives market value share by application, 2027 (%)

Regional Insights

As of 2018, Asia Pacific accounts for the largest share in the coating additives market, with a share of over 35% of the global market. Larger number of constructions works across different countries along with high industrial sector helps to drive the segment growth. North America is estimated to be the fastest growing region. Multiplying number of automotive players helps to fuel the market over the forecast period. The report is a thorough study which includes top companies, their annual presentations, industry publications, press releases and their drivers, opportunities, trends and the market understanding through different product and their ingredient type with growth factors and future expectancies in the coating additives market.Research Methodology

The following report consists of market analysis including both primary and secondary research. Primary research comprises the interaction between manufacturers, industry experts and channel partners, while the secondary research presents an analytical interpretation of relevant publications which contains details like proprietary databases, purchased database, company annual reports, and financial reports. For single, team and corporate user license, we will provide 15% free customization of the report. However, alternatively, if you are looking for additional data or insight related to the scope of the report, you may purchase the "Customized Research License". Please put an enquiry for the pricing details.Segments covered in the report

Type Outlook- Acrylics

- Fluoropolymers

- Urethanes

- Metallic Additives

- Others

- Rheology Modification

- Biocides Impact Modification

- Anti-Foaming

- Wetting & Dispersion

- Others

- Solvent-borne

- Water-borne

- Powder-based

- Architectural

- Automotive

- Industrial

- Wood & Furniture

- Others

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Asia Pacific

- China

- India

- Japan

- Central & South America

- Brazil

- Middle East & Africa

- South Africa

- All market drifts, drivers and opportunities

- Understanding the dynamics of the parent market

- Prime fluctuations of the business dynamics

- Historical, current, and projected size of the market with respect to production and sales

- Segmentation and comprehensive analysis in the second or third level

- Reporting and evaluation of recent industry developments

- Detailed profiling of leading companies

- Opportunities to newer trends in global, regional and country markets

- Analyzing the trajectory line of the business