Global Energy Drinks Market Size, Insights, Drivers, Opportunities, By Target Consumer (Teenagers, Adults, Geriatric Population), By Type (Non-Organic, Organic), By Product (Alcoholic, Non-Alcoholic), By Distribution Channel (On Trade, Off Trade and Direct Selling), By Region Growth, Trends and Forecast from 2019 to 2027

Global Energy Drinks Market Size, Insights, Drivers, Opportunities, By Target Consumer (Teenagers, Adults, Geriatric Population), By Type (Non-Organic, Organic), By Product (Alcoholic, Non-Alcoholic), By Distribution Channel (On Trade, Off Trade and Direct Selling), By Region Growth, Trends and Forecast from 2019 to 2027

Historic years: 2015 to 2017 Base Year: 2018 Forecast Years: 2019 to 2027

Number of pages: 100 Category: F&B Report Id: MISFnB5002

Market Insights

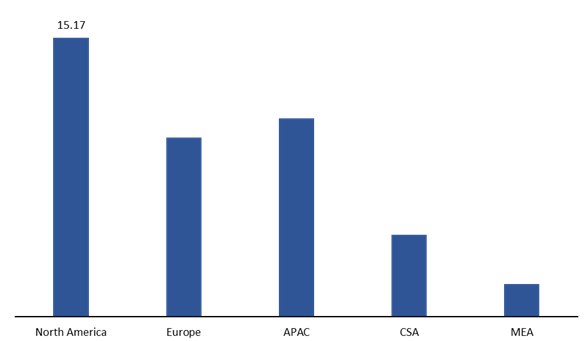

The global energy drinks market was valued at USD 51.11 billion in 2018 and is estimated to reach a value of USD 94.64 billion in 2027. The market is analyzed to rise at a CAGR of 7.08% over the forecast period of 2019 to 2027. Major driver attributing the market growth is growing healthy living lifestyle of consumers and busy lifestyles.Global Energy drinks market size by region, 2018 (USD Billion)

Earlier energy drinks were consumed by sports people. But now people are consuming more energy drinks because of their changing lifestyle. It has been observed that consumer of European countries prefers to have energy drinks instead of sugar beverages. Most of the people prefer to have mild alcoholic beverages on social parties, this leads to increased demand of such drinks which contains around 2 to 5% alcohol. As per manufacturers report these drinks helps to reduce muscle fatigue, protect heart health and ease the mental process.

Major ingredients present in energy drinks that helps in providing stimuli is caffeine. Another major component is Taurine which is one of the major ingredients that helps to develop skeletal muscle development and cardiovascular function.

Earlier energy drinks were consumed by sports people. But now people are consuming more energy drinks because of their changing lifestyle. It has been observed that consumer of European countries prefers to have energy drinks instead of sugar beverages. Most of the people prefer to have mild alcoholic beverages on social parties, this leads to increased demand of such drinks which contains around 2 to 5% alcohol. As per manufacturers report these drinks helps to reduce muscle fatigue, protect heart health and ease the mental process.

Major ingredients present in energy drinks that helps in providing stimuli is caffeine. Another major component is Taurine which is one of the major ingredients that helps to develop skeletal muscle development and cardiovascular function.

Target Consumer Insights

In terms of target consumer, adult segment was valued to be the largest market. In 2018, this category accounted for 47.55% of the global energy drinks market. The product is majorly consumed by the corporate people and atheists for extra booster that grows their performance. Teenager category is expected to be the fastest growing target consumer segment over the forecast period of 2019 to 2025. Energy drinks became a status symbol among teenagers, which is driving the growth of this market.Type Insights

Non-organic target consumer category was valued to hold the largest market. In 2018, this category accounts for above 80% of the global market. These products are available at low cost which attracted the consumer to purchase non organic drinks. Organic drinks category is expected to be the fastest growing type. Growing consumer awareness about organic product and its benefits are attributing to the expansion.Product Insights

Non alcoholic category is the largest and fastest growing product segment. It is expected to reach USD 85.85 Billion in 2027. Consumer growing awareness about the benefits of healthy products are driving the growth of this category. FDA has banned consumption of alcoholic energy drink which has strongly affected the commercial growth.Distribution Channel Insights

On trade distribution channel was valued to be the largest distribution channel category. In 2018 this category accounted for more than 70% of the global market. Consumer prefer to have energy drinks majorly in bars, coffee shops and restaurants. Off trade and direct selling category was estimated to be the fastest growing market over the forecasted period of 2019 to 2027. High discounts provided by the super and hypermarkets is the major factor affecting the market growth.Global energy drinks market value share by distribution channel, 2027 (%)

Regional Insights

North America is the largest energy drinks market. In 2018 North America accounted for 36.1% of the global market. A large number of millennials across the U.S. have a habit of consuming energy drinks in their daily life which is driving the growth. The Asia Pacific is the fastest growing energy drinks market. Major factors attributing the growth of this market are growing middle-class population.Competitive Landscape

Companies are investing on new product development to get the competitive advantage by launching innovative new products. Redbull and Monster Energy brands are positioned themselves as premium brands. They have a major share in the industry. By investing in sports events such as Formula One, Moto GP, Mountain Biking, Moto Cross, and others, these companies have increased their brand visibility in the global scenario.Research Methodology

The following report consists of market analysis including both primary and secondary research. Primary research comprises the interaction between manufacturers, industry experts, and channel partners, while the secondary research presents an analytical interpretation of relevant publications which contains details like proprietary databases, purchased database, company annual reports, and financial reports. For the single, team and corporate user license, we will provide 15% free customization of the report. However, alternatively, if you are looking for additional data or insight related to the scope of the report, you may purchase the "Customized Research License". Please put an inquiry for the pricing details.Highlights of the report:

- All market drifts, drivers and opportunities

- Understanding the dynamics of the parent market

- Prime fluctuations of the business dynamics

- Historical, current, and projected size of the market with respect to production and sales

- Segmentation and comprehensive analysis in the second or third level

- Reporting and evaluation of recent industry developments

- Detailed profiling of leading companies

- Opportunities to newer trends in global, regional and country markets

- Analyzing the trajectory line of the business

- Measures to consider for energy drinks in the industry

Segments covered in the report

Target consumer Outlook- Teenagers

- Adults

- Geriatric population

- Non-organic

- Organic

- Alcoholic

- Non-Alcoholic

- On-trade

- Off-trade & direct selling

- North America

- U.S

- Canada

- Mexico

- Europe

- U.K

- Italy

- Germany

- Asia Pacific

- China

- India

- Japan

- Australia

- Central & South America

- Middle East & Africa